pay personal property tax richmond va

Therefore the city has increased the amount of automatically applied Personal Property Tax also known as car tax Relief to offset our residents tax burden. Unsure Of The Value Of Your Property.

The tax rate is 1 percent charged to the consumer at the time of rental payment.

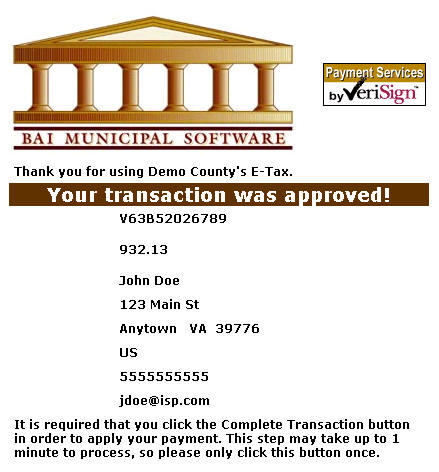

. See Results in Minutes. Pay Personal Property Taxes. You can pay your personal property tax online with an electronic check by using our Easy Check program which offers two convenient options.

Doxo is the Simple Secure Way to Pay Your Bills. Access City of Virginia Official Website. Pay Your Bill with doxo.

Pay all business taxes. Electronic Check ACHEFT 095. Personal Property Tax is responsible for the assessment of all vehicles cars trucks buses motorcycles boats and motor homes that are taxable in the City of Alexandria.

Newport News VA 23607 Phone. Call 18333391307 18333391307 Individual income tax bills - choose Individual Bill Payments Business tax bills - choose Business Bill Payments Have your 5-digit bill number. If payment is late a 10 late payment penalty is assessed on the unpaid original tax.

Fax Numbers 804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours. 1 View Download Print and Pay Richmond VA City Property Tax Bills. Personal Property Tax Payment History.

Personal Property Tax Rate. Ad Pay Your City of Richmond Personal Property Taxes Bill with doxo Today. Real Estate and Personal Property Taxes Online Payment.

Selecting options for consulting taxes. 295 with a minimum of 100. Offered by City of Richmond Virginia.

The rate is set annually by the York County Board of Supervisors in the month of May. 420 per 100. Pay bills or set up a payment plan for all individual and business taxes.

Ad Enter Any Address Receive a Comprehensive Property Report. Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date. Tax Rate The Personal Property tax rate for 2021 is 4 per 100 of assessed value.

Tax Pay My Way. If you have any questions about how to pay your real estate taxes or want to receive assistance understanding your bill please contact the Virginia Tax Department at 804. Register to Receive Personal Property Tax Bills Electronically E-Billing.

Make tax due estimated tax and extension payments. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. Find All The Record Information You Need Here.

For additional information please visit the Finance Department Revenue Division website or call.

Councilor Katherine Jordan Facebook

Many Left Frustrated As Personal Property Tax Bills Increase

Virginia Car Taxes Going Up Why Your Car Is Worth More In 2021 Wusa9 Com

Easy Check Newport News Va Official Website

City Of Richmond Extends Personal Property Tax Deadline To August Wric Abc 8news

What Best Predicts Violence In Richmond Neighborhoods Negligent Landlords

Estate Sale Companies Prestige Estate Services

Richmond Property Tax 2022 Calculator Rates Wowa Ca

Check Yes For Henrico Va Presentation For Henrico County Residents And Civic Groups April Ppt Download

Property Taxes How Much Are They In Different States Across The Us

Personal Property Vehicle Tax City Of Alexandria Va

Virginia Property Tax Calculator Smartasset

Richmond Extends Deadline To Pay Personal Property Taxes Wric Abc 8news

Occupational Employment And Wages In Richmond May 2021 Mid Atlantic Information Office U S Bureau Of Labor Statistics